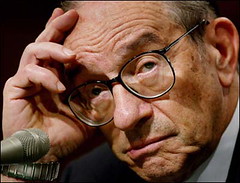

First the “no fault of mine” fantasy provided by Ayn Rand acolyte Alan Greenspan.

TAPPER: You’ll be testifying about the financial crisis on Wednesday before the Financial Crisis Inquiry Commission. When you testified before Congress in October, you said that you finally saw a flaw in — in the way that you looked at markets, that markets cannot necessarily be trusted to completely police themselves. But isn’t it — isn’t it more than a flaw? Isn’t it an indictment of Ayn Rand and the view that laissez-faire capitalism can be expected to function properly, that markets can be trusted to police themselves?

GREENSPAN: Not at all. I think that there is no alternative, if you want to have economic growth and higher standards of living, in a democratic society, to have competitive markets. And, indeed, if you merely look at the history since the Enlightenment of the 18th century, when all of those ideas surfaced and became applicable in public policy, we’ve had an explosion of economic growth, and especially in the developing countries, where hundreds of millions of people have been pulled out of poverty, of extreme poverty and starvation, basically because we have competitive markets.

via Greenspan: Financial Crisis Doesn’t Indict Ayn Rand Theories – Political Punch.

Now the reality courtesy of Michael Burry manager of the hedge fund Scion Capital from 2000 to 2008.

During 2007, under constant pressure from my investors, I liquidated most of our credit default swaps at a substantial profit. By early 2008, I feared the effects of government intervention and exited all our remaining credit default positions — by auctioning them to the many Wall Street banks that were themselves by then desperate to buy protection against default. This was well in advance of the government bailouts. Because I had been operating in the face of strong opposition from both my investors and the Wall Street community, it took everything I had to see these trades through to completion. Disheartened on many fronts, I shut down Scion Capital in 2008.

Since then, I have often wondered why nobody in Washington showed any interest in hearing exactly how I arrived at my conclusions that the housing bubble would burst when it did and that it could cripple the big financial institutions. A week ago I learned the answer when Al Hunt of Bloomberg Television, who had read Michael Lewis’s book, “The Big Short,” which includes the story of my predictions, asked Mr. Greenspan directly. The former Fed chairman responded that my insights had been a “statistical illusion.” Perhaps, he suggested, I was just a supremely lucky flipper of coins.

Mr. Greenspan said that he sat through innumerable meetings at the Fed with crack economists, and not one of them warned of the problems that were to come. By Mr. Greenspan’s logic, anyone who might have foreseen the housing bubble would have been invited into the ivory tower, so if all those who were there did not hear it, then no one could have said it.

As a nation, we cannot afford to live with Mr. Greenspan’s way of thinking. The truth is, he should have seen what was coming and offered a sober, apolitical warning. Everyone would have listened; when he talked about the economy, the world hung on every single word.

Unfortunately, he did not give good advice. In February 2004, a few months before the Fed formally ended a remarkable streak of interest-rate cuts, Mr. Greenspan told Americans that they would be missing out if they failed to take advantage of cost-saving adjustable-rate mortgages. And he suggested to the banks that “American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage.”

Within a year lenders made interest-only adjustable-rate mortgages readily available to subprime borrowers. And within 18 months lenders offered subprime borrowers so-called pay-option adjustable-rate mortgages, which allowed borrowers to make partial monthly payments and have the remainder added to the loan balance (much like payments on a credit card).

Observing these trends in April 2005, Mr. Greenspan trumpeted the expansion of the subprime mortgage market. “Where once more-marginal applicants would simply have been denied credit,” he said, “lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately.”

via Op-Ed Contributor – I Saw the Crisis Coming. Why Didn’t the Fed? – NYTimes.com.

Greenspan has reset himself inside his own mind after the economy was almost destroyed by a fire he either unwittingly or recklessly fueled. Now, Greenspan wants to reset the lessons of the last 10 years and go back to a time when he was ever the Oracle and Michael Burry “was just a supremely lucky flipper of coins”. Only fools would let him do that.