In 1930, U.S. officials stood aside as banks failed; the result was the Great Depression. In 2008, they stood aside as Lehman Brothers imploded; within days, credit markets had frozen and we were staring into the economic abyss.

So it’s crucial to avoid disorderly bank collapses, just as it’s crucial to avoid out-of-control urban fires.

Since the 1930s, we’ve had a standard procedure for dealing with failing banks: the Federal Deposit Insurance Corporation has the right to seize a bank that’s on the brink, protecting its depositors while cleaning out the stockholders. In the crisis of 2008, however, it became clear that this procedure wasn’t up to dealing with complex modern financial institutions like Lehman or Citigroup.

So proposed reform legislation gives regulators “resolution authority,” which basically means giving them the ability to deal with the likes of Lehman in much the same way that the F.D.I.C. deals with conventional banks. Who could object to that?

Well, Mr. McConnell is trying. His talking points come straight out of a memo Frank Luntz, the Republican political consultant, circulated in January on how to oppose financial reform. “Frankly,” wrote Mr. Luntz, “the single best way to kill any legislation is to link it to the Big Bank Bailout.” And Mr. McConnell is following those stage directions.

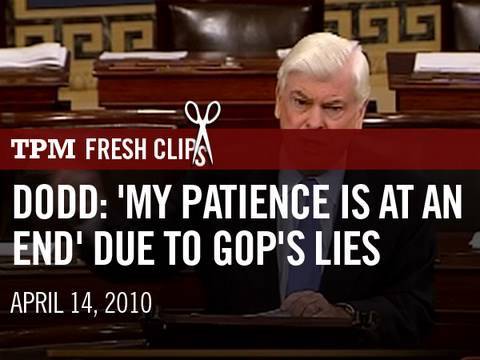

Mitch McConnell’s position makes no sense, and yet he is keeping the troops in line and is opposing regulation that would allow bad Wall Street Banks to fail without pulling our entire economy into a depression. There is no capitalist in the GOP if they don’t support resolution authority. Instead they love corporate welfare. This is a much easier sell than health care, and a populist winner if there was one. Democrats need to push hard on this.

McConnell’s lies at work below: