h/t to Janet Novack in Forbes for breaking down the math:

But since I write about tax and budget issues, let me make a few serious points about the 46.4% of American households who paid no federal income taxes for 2011. First of all, according to the Tax Policy Center, more than 60% of those non-income tax paying households did pay federal payroll taxes—meaning Social Security and Medicare taxes. (Considering all Americans households, including those that owed income tax, 62% paid more in payroll taxes than in federal income taxes.)

What of the 18.1% of U.S. households that paid neither income nor payroll taxes? More than half of them were headed by a senior–in other words, by someone who paid payroll taxes and likely some income taxes too, in the past. (No, the amount the elderly have paid in does not cover the cost of the Medicare benefits they are now getting. And that is true despite the fact that in a Romney TV adattacking Obamacare’s cuts to the growth in Medicare spending, an announcer seems to suggest otherwise, intoning: “You paid into Medicare for years, every paycheck…. So now the money you paid for your guaranteed healthcare Is going to a massive new government program that’s not for you.”)

Of course, it goes without saying, that those folks who aren’t paying federal taxes are almost all paying state and local taxes—state sales taxes, real estate taxes (either on their homes or built into their rents) and possibly state income taxes too, since those taxes tend to exempt fewer poor families than does the federal income tax. If they buy gasoline, liquor or tobacco, or have telephones, they’re also feeding the federal purse.

Yes, there’s a serious tax policy issue here. The percentage of households owing federal individual income taxes has fallen in recent years in part because both Republicans and Democrats have looked to provide help for working families through the child credit, the earned income tax credit and other “tax expenditures,” rather than through more direct spending programs. That might not be the best way to do things. But note again that the largest group excluded from paying income tax because of special tax expenditures are seniors, who get a bigger standard deduction than younger folks and more importantly, special tax treatment for their Social Security benefits.

source: Memo To Mitt Romney: The 47% Pay Taxes Too – Forbes.

Nothing Romney says is elegantly stated and a lot of it is just plain stupid. That bold in Novack’s article was mine: Only 18.1% pay no income or payroll tax and most of THESE households are elderly.

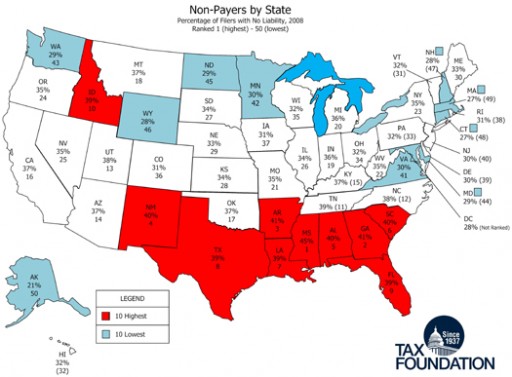

And look, here’s the real deal…the states with most non-income tax payers:

Also, remember “red states” get more tax money in than money paid to the federal government.

Any way you put it the real people he’s arguing against a lot of members in his base. He represents tax revenue protectionists, not tax revenue cutters.